Easy-to-use, modern financial planning software to power your advice business

Take your client service to the next level with AdviserLogic

Already have an account? Sign in.

Focus on your clients, not your technology

It takes a lot of time and energy to run an advice business. Regulatory changes, rising business costs and complex technology can distract you from consistently delivering the quality of service you want to provide to your clients. AdviserLogic can help you optimise your business and refocus on delivering exceptional advice experiences.

Streamline your advice process

Discover more efficient ways to run your business, deliver advice and build trust with your clients. Provide exceptional client experiences that grow your business and put more people on the path to prosperity.

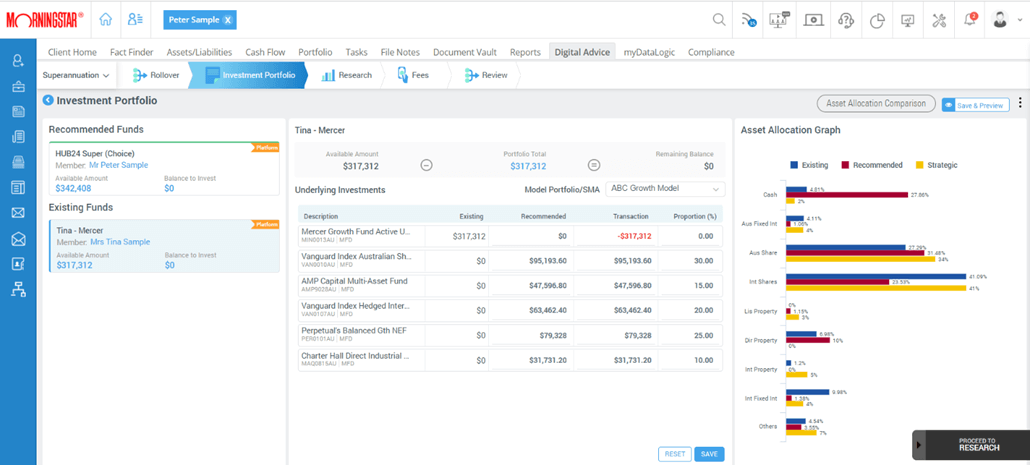

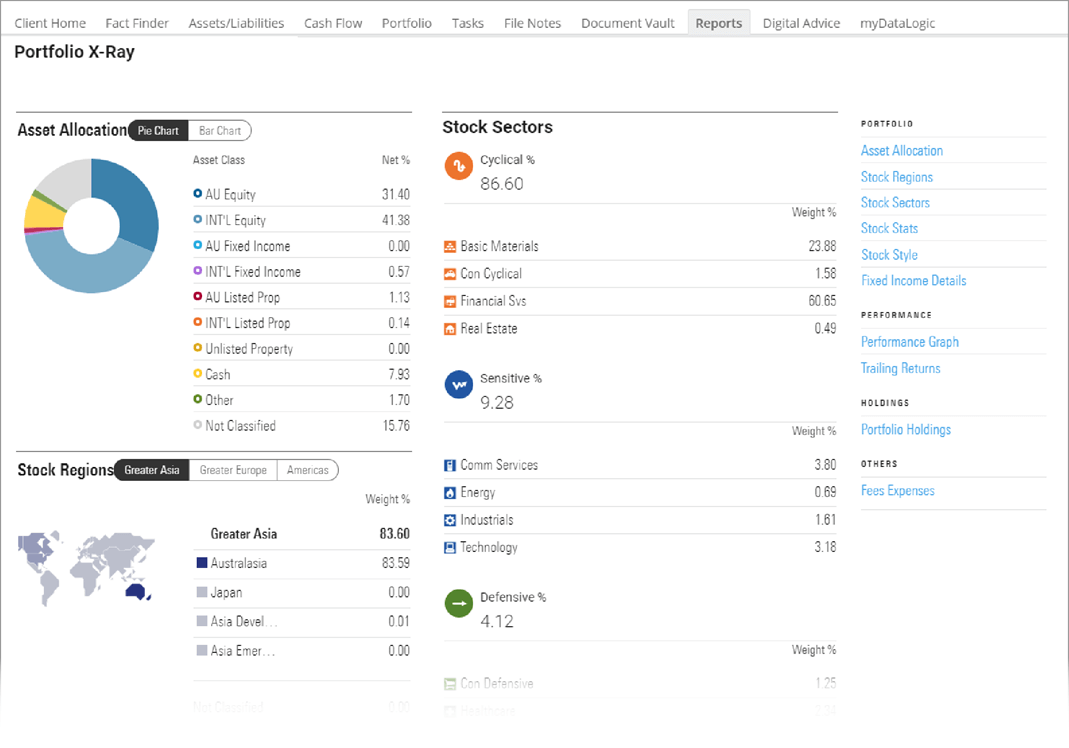

Research and build portfolios

Backed by Morningstar’s extensive data and research – analyse portfolios, research investments and substantiate advice to help your clients reach their goals.

Enhance client engagement

Smart tools dramatically reduce the time needed to learn about your clients and think through their goals, helping you engage meaningfully and efficiently.

Ready to see for yourself?

Why choose AdviserLogic?

Efficient and engaging advice documents

Select pre-built strategies, compare products and generate a statement of advice within a single guided workflow. Simplifying the complex and bringing data to life with elegant, easy-to-digest reports and visualisations. AdviserLogic guides you through the required steps to help address compliance requirements to save significant time in generating and presenting engaging advice to your clients.

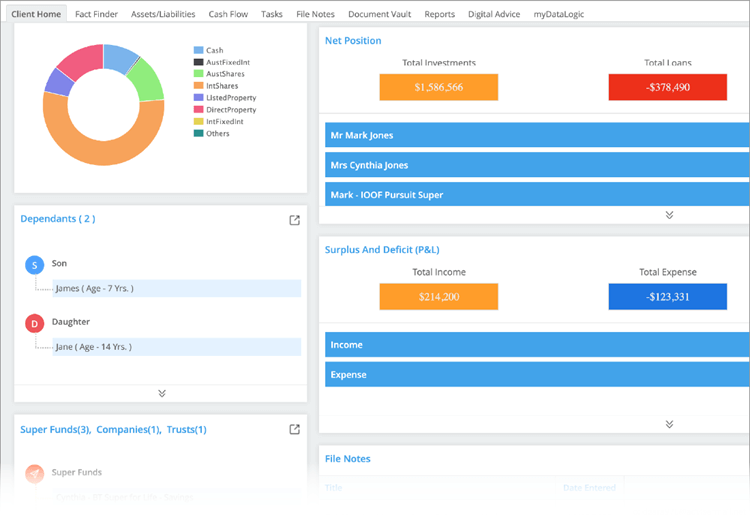

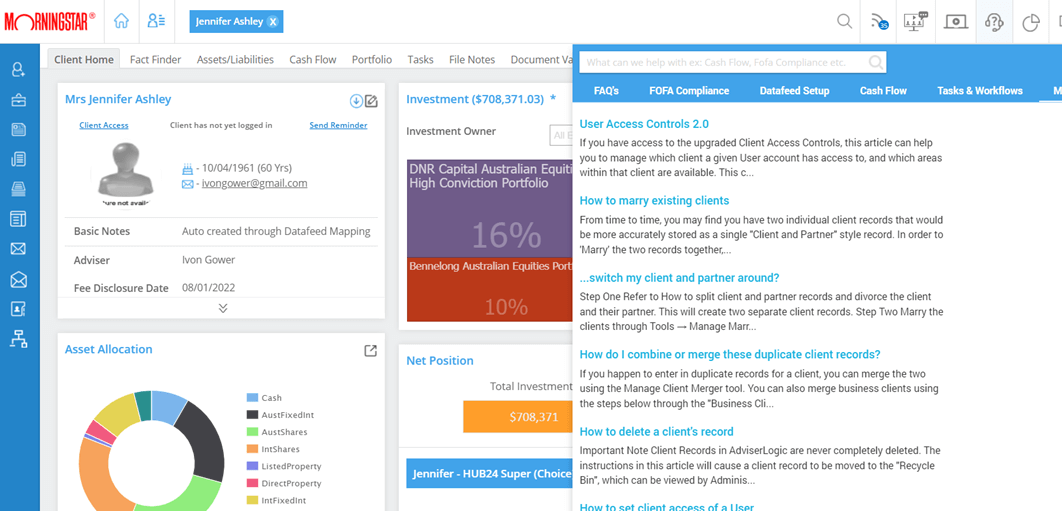

Powerful technology and reporting

AdviserLogic’s CRM capability enables you to run your office from a single application, designed by advisers for advisers. Integrate client data from platforms, funds, life insurers and banks – streamlining your reporting and helping you engage with your client base.

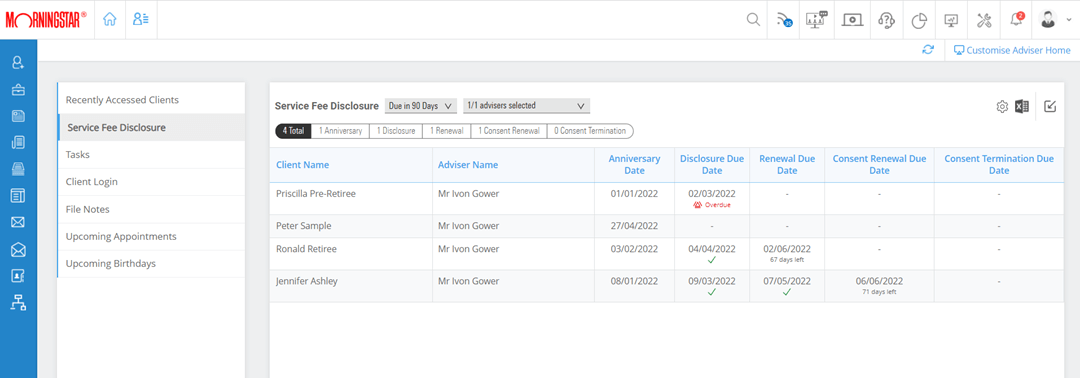

Built-in compliance support

Consolidate client records and file notes in one place to simplify and strengthen your record keeping. You can also integrate client service delivery with our revenue management system, and leverage Morningstar data research reports to substantiate your advice.

Backed by the trusted Morningstar brand

AdviserLogic is backed by Morningstar’s extensive research and data – seamlessly connecting with goal setting, risk assessment and investment planning to help your clients reach their goals.

Onboarding and ongoing customer support

We offer robust training and outstanding support through our local teams in Australia and offshore teams in India. Our dedicated customer support team can be reached by phone, email or in person to help optimise your software, train new users and troubleshoot any issues.

Ready to see for yourself?

Get the most out of AdviserLogic

Dedicated Support

Our support teams will guide you through product set-up. Afterwards, they remain available to answer all your questions.

Setting You Up For Success

Get product walk throughs and time-saving tips with regular webinars hosted by our customer success team.

Manage Revenues

Integrate our revenue management feature to efficiently track and monitor payments.

Local Team of Specialists

Maximise your subscription with our team of product, industry and customer success specialists based in Sydney, Melbourne and Brisbane.

Independent Investment Research

Power your practice with a subscription to Morningstar‘s market leading research, recommendations, and reports.

Seamless integrations with your existing systems

Integrate your existing systems and third-party business applications using our open APIs and connect to over 2,000 applications with our Zapier integration. Our platform fully integrates with various third-party data feeds and applications to support the way you want to work.

Data and research

Third party applications

Zapier Integrations

Investment and insurance data feeds

See what our clients are saying about AdviserLogic

Conaill Keniry, Financial Adviser | Director – What If Advice